Maximize Tax Savings with Real Estate Tax Software

Controlling property taxes can usually sense overwhelming, with complex calculations, moving regulations, and the constant stress to minimize liabilities. But in today's electronic age , property tax application is emerging as a strong instrument to greatly help home homeowners, investors, and businesses improve rental property tax software while saving money.

Why Real Estate Tax Software is a Game-Changer

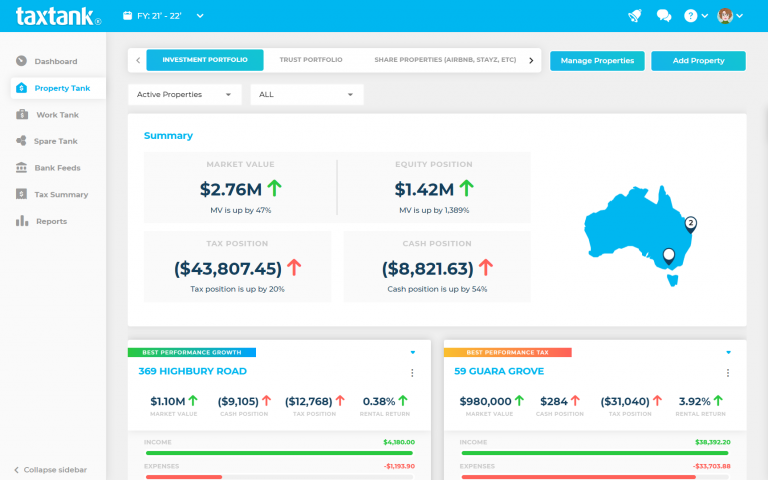

Recent statistics spotlight the substantial economic great things about leveraging sophisticated engineering for duty management. Based on surveys, organizations that embrace automated tax alternatives report up to and including 20% lowering of preparation and processing errors. These errors not only cost time but often result in penalties that has been avoided. By removing handbook functions and individual problems, real estate tax computer software ensures greater reliability and compliance.

Also, home owners can enhance deductions and discover missed possibilities for savings. Many systems now use advanced formulas to immediately recognize and sort deductible expenses, such as for example depreciation, preservation charges, and fascination payments. With tax auditors stating incomplete or inaccurate deductions among the prime causes for audits, the ability to enhance reliability becomes invaluable.

Key Benefits of Using Real Estate Tax Software

One of the many amazing features of modern tax pc software is its power to include with current systems. Whether handling multiple qualities or a simple hire product, customers can quickly track money, expenses, and tax liabilities in real-time. Automated confirming features further enable users by giving clear insights within their tax condition, enabling practical preparing before tax season.

Yet another critical benefit is keeping up-to-date with shifting tax regulations. Laws surrounding property taxes are continually growing, and lacking key updates can cause expensive submission issues. Tax software providers often upgrade their platforms immediately to reflect the latest rules and duty requirements, ensuring that consumers remain educated and compliant.

Simultaneously, in regards to audits, having arranged and easily accessible documentation is crucial. Real estate tax computer software assists maintain centralized files, eliminating the chaotic last-minute scramble for bills or documentation.

Take Control of Your Tax Strategy

Real estate tax computer software gives significantly more than comfort; it offers users a significant side in optimizing savings, increasing submission, and simplifying the overwhelming task of tax management. By adopting that cutting-edge technology, home homeowners and organizations can concentrate on growth while making the burden of calculations and submission to a reliable, computerized system.